How SBTi 2.0 Changes the Carbon Credit Decisions Companies Must Make

Introduction

Corporate climate action is entering a new phase of accountability. As net-zero commitments multiply, so does scrutiny around carbon credits, offsetting practices, and greenwashing claims. Regulators, investors, and civil society are increasingly questioning whether corporate climate claims reflect real emissions reductions or rely on low-integrity credits.

In this context, the Science Based Targets initiative (SBTi) has become a critical benchmark for credible corporate climate strategies. The release of the draft Corporate Net-Zero Standard 2.0 marks more than a routine technical update, it represents a strategic shift in how companies are expected to plan, validate, and communicate their climate actions (SBTi, 2024).1

SBTi 2.0 sharpens expectations around near-term decarbonisation, Scope 3 accountability, and governance, while also redefining the role of carbon credits. Credits are no longer positioned as substitutes for emissions reductions, but as tools with clearer boundaries, particularly through Beyond Value Chain Mitigation (BVCM) and a growing emphasis on high-integrity credits and carbon removals2.

Core thesis: SBTi 2.0 forces companies to rethink when, how, and why they use carbon credits, shifting carbon decisions from a compliance exercise to a strategic leadership choice.

This article unpacks what has changed, how carbon credits are being repositioned, and the practical implications for corporate buyers navigating an increasingly integrity-driven carbon market.

What SBTi 2.0 Is Trying to Fix

SBTi 1.x was instrumental in driving corporate adoption of science-based targets, but it increasingly showed limitations as climate scrutiny intensified. The framework focused heavily on target-setting, with limited mechanisms to assess delivery, progress, or corrective action once targets were approved.

There was also ambiguity around carbon credits. While SBTi encouraged emissions reductions over offsetting, guidance on when and how credits could be used, particularly for neutralisation and beyond value chain mitigation, remained unclear, creating room for inconsistent interpretation (SBTi Net-Zero Standard v1.0).3

Additionally, Scope 3 emissions, often representing the majority of a company’s footprint, lacked strong enforcement and actionable guidance, weakening accountability across value chains.

As concerns over greenwashing and unverifiable climate claims grew, stakeholders began demanding measurable outcomes rather than aspirational commitments (VCMI Claims Code). SBTi 2.0 reflects this shift, from commitment to performance, making carbon credit use more disciplined, transparent, and strategically accountable (SBTi Draft NZS 2.0).

From Targets to Accountability: The Structural Shift in SBTi 2.0

SBTi 2.0 marks a clear move from one-time target approval to continuous accountability. Unlike SBTi 1.x, which focused mainly on validating commitments, the new framework evaluates how companies perform over time.

The standard now includes multiple checkpoints, entry checks, initial validation, renewal validation, and ongoing assessment, ensuring climate targets remain credible, science-aligned, and actively delivered, not just declared.

Another major change is the tightening of climate claims. Under SBTi 2.0, claims must be backed by measurable progress and transparent reporting. Broad statements like “carbon neutral” without performance evidence face greater scrutiny.

This structural shift directly impacts carbon credit decisions. Credits are no longer a fallback for slow decarbonisation. Their use must be justified, limited to residual emissions, and aligned with Beyond Value Chain Mitigation (BVCM)2,3 and high-integrity standards.

Carbon Credits Under SBTi 2.0: What’s Explicitly Changed

SBTi 2.0 introduces a much clearer distinction between where emissions reductions must occur and how carbon credits can responsibly support climate action.

Direct mitigation refers to emissions reductions achieved within a company’s own operations and value chain, across Scope 1, 2, and 3. This includes energy efficiency, renewable energy adoption, supplier engagement, and operational redesign. Under SBTi 2.0, direct mitigation remains the primary and non-negotiable pathway4,5 to meeting climate targets.

Indirect mitigation captures actions that influence emissions reductions beyond a company’s immediate footprint, such as enabling supplier transitions, financing low-carbon technologies, or supporting sectoral decarbonisation initiatives. While valuable, these actions do not substitute for required value-chain reductions.

Beyond Value Chain Mitigation (BVCM) is now explicitly positioned as a separate and complementary category. BVCM involves financing emissions reductions or removals outside a company’s value chain, typically through high-integrity carbon credits. Crucially, these activities do not offset a company’s own emissions6,7 but demonstrate climate leadership beyond compliance.

As a result, carbon credits are no longer framed as generic “offsets.” Their use is contextual, linked to residual emissions, claim types, and the maturity of a company’s decarbonisation pathway. Credits must support, not mask, performance.

Implications for Corporate Procurement Teams

For procurement and sustainability teams, this shift requires tighter governance, clearer internal decision rules, and stronger due diligence. Credit purchasing must now align with strategy, claims, and reporting, elevating carbon procurement from a transactional exercise to a strategic, auditable function.

Residual Emissions: Where Removals Enter the Equation

Under SBTi 2.0, residual emissions are defined as the remaining, unavoidable emissions that persist after a company has implemented all feasible and science-aligned emissions reductions. These are emissions that cannot be eliminated due to technological, economic, or physical constraints, particularly in hard-to-abate activities.

Importantly, SBTi 2.0 limits the formal use of carbon dioxide removals (CDR) to address Scope 1 residual emissions only. This is a deliberate design choice. By restricting removal targets to direct operational emissions, SBTi reinforces the principle that companies must first decarbonise their own activities before relying on removals, rather than using them to compensate for value-chain inaction.

Three Proposed Approaches to Removals

SBTi 2.0 outlines three possible ways companies may be required, or allowed, to address residual emissions:

Mandatory removals

Companies would be required to neutralise Scope 1 residual emissions using verified carbon removals at the net-zero target year. This approach offers the highest level of environmental integrity but creates clear compliance obligations.

Optional removal targets

Companies may voluntarily set removal targets to address residual emissions, signaling climate leadership beyond minimum requirements while retaining flexibility.

Flexibility via reductions or removals

Companies could choose between deeper reductions or removals to manage residual emissions, acknowledging sectoral and technological differences while maintaining accountability.

From Reductions to Removals: Managing Residual Emissions

Why This Creates Limited but Real CDR Demand

Because removals apply only to residual Scope 1 emissions, total demand for CDR remains constrained, not exponential. However, the demand that does emerge is high-quality, long-duration, and integrity-driven, favouring durable removals over low-cost offsets. This creates a smaller but more credible market signal for carbon removal technologies.

Strategic Choices Companies Must Make

Companies must now decide how much residual risk they are willing to carry, whether to invest early in removals, and how removals fit within long-term capital planning. Under SBTi 2.0, removals are no longer symbolic, they are strategic, auditable, and tightly scoped decisions.6

Ongoing Emissions and BVCM, Optional, Recognised, Uncertain

Under SBTi 2.0, ongoing emissions refer to emissions that continue to occur before a company reaches its net-zero target year, even as it follows a science-based decarbonisation pathway. These emissions are expected to decline steadily over time but are not yet classified as residual emissions, which apply only at net zero.

To address these ongoing emissions, SBTi introduces Beyond Value Chain Mitigation (BVCM) as a parallel pathway, not a substitute for required emissions reductions. BVCM involves financing emissions reductions or removals outside a company’s value chain, typically through high-integrity carbon credits. Crucially, BVCM does not offset a company’s own emissions or replace decarbonisation obligations. Instead, it sits alongside them as a signal of climate leadership.

Optional Recognition, Not a Requirement

A defining feature of SBTi 2.0 is that BVCM remains optional. Companies are encouraged, but not required, to invest in BVCM, and recognition for doing so is still evolving. This optional status reflects ongoing debates around claims, integrity, and consistency, but it also introduces uncertainty around incentives.7,8

Why This Matters for Incentives

Because BVCM is not mandatory and recognition is limited, companies may deprioritise it, especially under cost or performance pressure. This creates a risk of underutilisation, even where high-quality projects could deliver real climate benefits today. Without clearer signals or rewards, corporate finance may flow only toward minimum compliance rather than additional impact.

Reframing Voluntary Carbon Credit Use

SBTi 2.0 reframes voluntary carbon credit use from a compensation tool to a leadership action. Credits used under BVCM demonstrate ambition beyond targets, not progress toward them. This elevates the strategic and reputational dimension of voluntary action, while narrowing the scope for generic offset claims.

Implications for Scope 3: Heavy Companies

For companies with large Scope 3 emissions, BVCM offers a structured way to act while long-term value-chain reductions take time. However, its optional nature means leadership, not obligation, will determine who participates.9

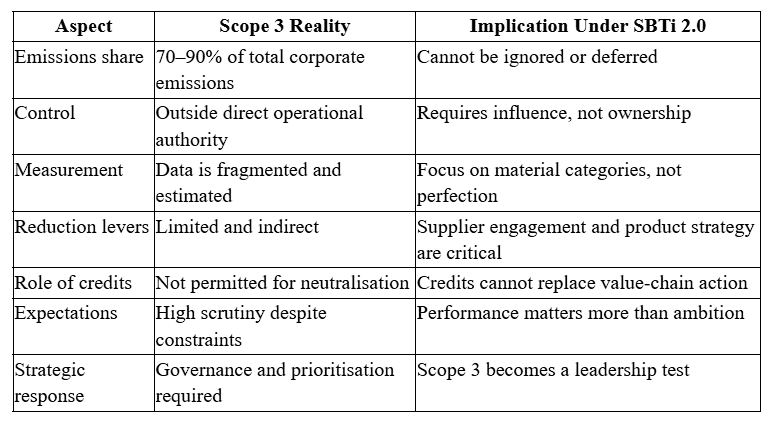

Scope 3 Remains the Hardest Problem

For most companies, Scope 3 emissions dominate the footprint, often accounting for 70–90% of total emissions. These emissions arise from activities outside direct operational control, such as purchased goods and services, logistics, product use, and end-of-life treatment. While they represent the largest climate impact, they are also the most difficult to measure, influence, and reduce. Recognising this challenge, SBTi 2.0 strengthens its relevance-based Scope 3 approach. Rather than treating Scope 3 as a single aggregated number, companies must now prioritise material emissions categories and demonstrate targeted action where climate impact is greatest.10,11

This shifts the focus from broad ambition to practical accountability, requiring companies to show how supplier engagement, procurement strategies, and product redesign contribute to real reductions over time. However, carbon credits play a limited role in Scope 3 abatement under SBTi 2.0. Credits cannot substitute for value-chain reductions, nor can they be used to neutralise Scope 3 emissions in place of action. This reflects growing consensus that offsetting value-chain emissions risks masking inaction rather than driving structural change. The Tension Companies Face This creates a clear tension for corporate climate leaders: Few direct reduction levers: Companies often lack authority over suppliers, customers, and downstream users. High expectations: Despite limited control, companies are expected to deliver measurable Scope 3 progress aligned with science-based pathways. Limited credit guidance: While BVCM offers a parallel leadership pathway, it does not resolve Scope 3 compliance requirements.

Decisions Companies Must Now Navigate Under SBTi 2.0, companies must decide where to focus limited resources, how to prioritise high-impact categories, and how to embed climate criteria into procurement, product strategy, and supplier relationships. Success will depend less on purchasing credits and more on governance, influence, and long-term collaboration across value chains. Bottom line: Scope 3 is no longer a peripheral disclosure challenge, it is the central test of corporate climate credibility.9

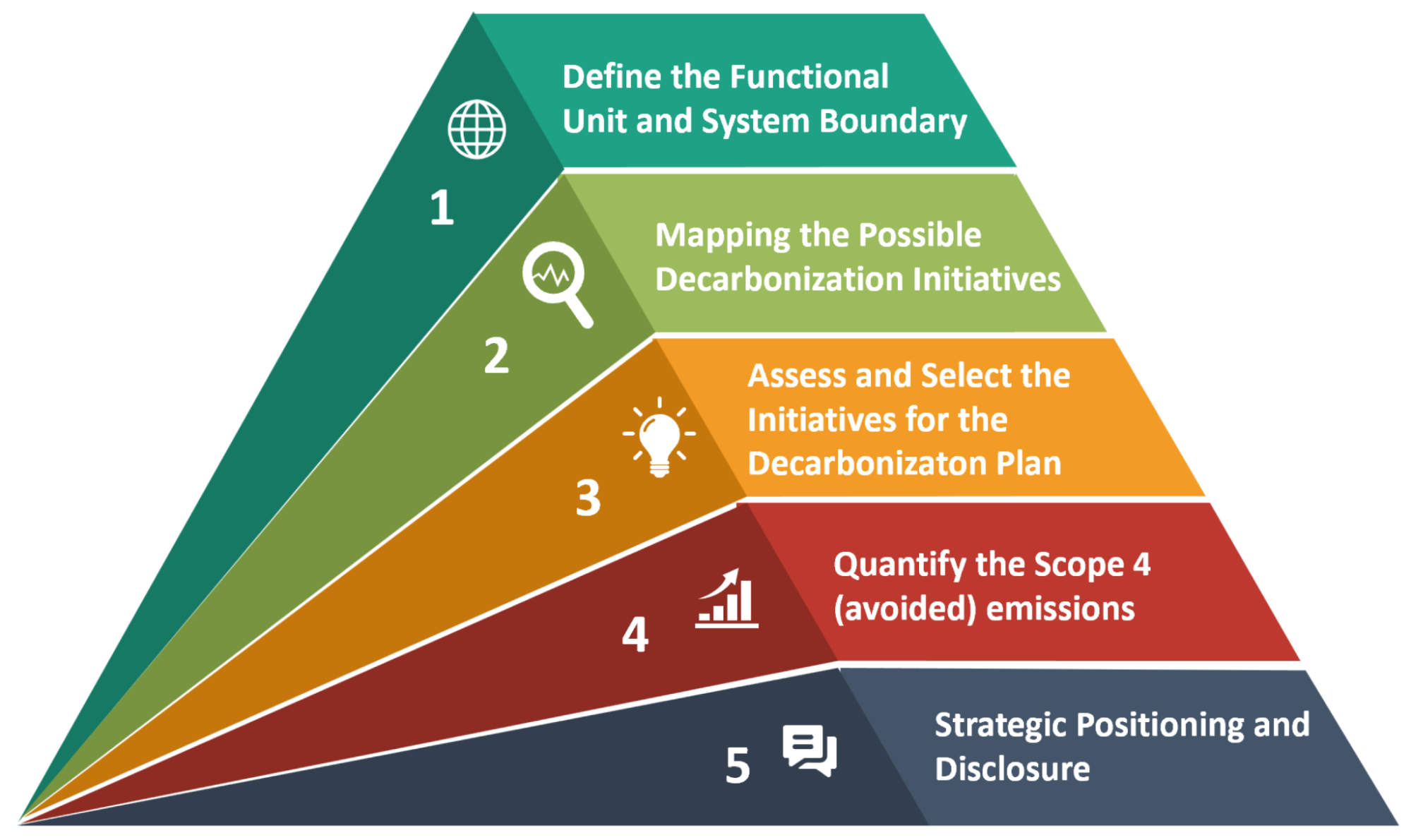

The New Decision Framework for Carbon Credit Buyers

Under SBTi 2.0, carbon credit purchasing is no longer a simple procurement exercise. Buyers must now navigate context, intent, and integrity, making explicit choices about why a credit is being used and what claim it supports. The question is no longer “Is this credit cheap or available?” but “Is this credit appropriate for the decision we are making?”

Key Questions Companies Must Now Ask

Is this credit for residual emissions or ongoing emissions?

Credits used to neutralise residual emissions at net zero face the highest scrutiny and must align with strict SBTi criteria. Credits used during the transition period apply only to BVCM and do not count toward target achievement.10,11Is it a removal or an avoidance credit?

SBTi 2.0 clearly distinguishes between emissions avoidance and carbon removals. Avoidance credits may support BVCM activities, but removals are expected for residual emissions, especially where long-term neutrality claims are made.What durability does SBTi expect here?

Not all removals are equal. Higher durability, measured in decades to centuries, carries greater credibility under SBTi, particularly for neutralisation at net zero. Short-lived storage may be insufficient for long-term claims.Is this credit for mitigation or BVCM recognition?

Credits no longer serve as a blanket mitigation tool. Buyers must decide whether the credit supports compliance with emissions targets (limited scope) or voluntary BVCM recognition as a leadership signal.

New Trade-Offs Buyers Must Manage

Cost vs durability

Lower-cost credits often offer shorter permanence, while high-durability removals demand higher upfront investment.Optional recognition vs real impact

BVCM recognition is voluntary, but high-quality credits can still deliver real climate benefits beyond compliance.Near-term optics vs long-term credibility

Cheap credits may satisfy short-term optics, but SBTi 2.0 rewards strategies that withstand long-term scrutiny and future claims assessment.

How Carbon Credit Procurement Must Evolve

SBTi 2.0 fundamentally changes how companies should approach carbon credit procurement. What was once an opportunistic, price-driven exercise, often focused on securing the lowest-cost credits available, must now evolve into a deliberate, portfolio-based strategy aligned with long-term climate commitments and claims integrity.

Under the new framework, carbon credits are no longer interchangeable commodities. Buyers must consider why a credit is being purchased, what role it plays in the company’s climate strategy, and how it will be scrutinised over time. This shift demands a move away from one-off, spot purchases toward a balanced portfolio that reflects different use cases, such as near-term BVCM leadership, longer-term removal needs, and future net-zero neutralisation.

Raising the Bar on Credit Quality

Three attributes become non-negotiable:

Traceability:

Companies must be able to trace credits back to specific projects, methodologies, and vintages, ensuring they can defend claims years after purchase.MRV quality:

Robust monitoring, reporting, and verification are critical to demonstrate that emissions reductions or removals are real, additional, and durable, especially as scrutiny intensifies.Transparency:

Clear disclosure of how credits are used, what claims they support, and what they do not represent is essential to avoid reputational risk.

Planning Beyond Spot Purchases

SBTi 2.0 encourages multi-year planning over reactive buying. Long-term offtake agreements and forward-looking procurement strategies help companies secure access to high-integrity credits, particularly durable removals, while managing price volatility and supply constraints. This approach also signals commitment to market development rather than short-term compliance.

Why Expert Guidance Becomes Critical

As standards tighten and claims become auditable, carbon procurement increasingly sits at the intersection of science, policy, finance, and communications. Expert guidance is essential to navigate evolving rules, assess project quality, and align procurement decisions with credible climate narratives. In this new landscape, informed strategy, not convenience, determines credibility.12

Hestiya Enabling Smarter Carbon Decisions in the SBTi 2.0 Era

As SBTi 2.0 raises the bar for integrity, accountability, and claims discipline, companies need more than access to carbon credits, they need decision confidence. This is where platforms like Hestiya play a critical enabling role. Hestiya is designed for a world in which carbon credits are no longer interchangeable commodities, but context-dependent instruments tied to specific use cases, residual emissions, removals, or BVCM leadership. By combining high-integrity project sourcing with digital monitoring, reporting, and verification (MRV), Hestiya helps companies align carbon credit decisions with the expectations of SBTi 2.0. Crucially, Hestiya supports the shift from volume-based buying to portfolio strategy. Companies can evaluate credits based on durability, traceability, MRV quality, and claims relevance, ensuring that each credit purchased is defensible over time. This is particularly important as SBTi moves from commitment-based validation toward ongoing performance assessment and claims scrutiny. For companies navigating optional but recognised pathways such as Beyond Value Chain Mitigation, Hestiya provides the infrastructure to demonstrate leadership without overstating impact. Transparent data, auditable records, and real-time monitoring help ensure that voluntary action strengthens credibility rather than increasing greenwashing risk. In a carbon market shaped by tighter standards and higher expectations, Hestiya’s role is not to replace corporate decarbonisation efforts, but to make every carbon decision clearer, smarter, and more accountable. As SBTi 2.0 makes carbon credit choices unavoidable, platforms that enable integrity-driven decision-making become essential.

Conclusion:

SBTi 2.0 does not eliminate carbon credits, it redefines their purpose. Credits are no longer a flexible shortcut to meet climate commitments or manage reputational risk. Instead, they are repositioned as structured tools with clearly defined roles, strict boundaries, and heightened scrutiny. Under this new framework, companies face harder and more strategic choices. They must decide when credits are appropriate, what type of credits are credible, and which claims those credits can legitimately support. This forces a shift away from volume-based purchasing toward intentional, context-specific use, aligned with decarbonisation pathways rather than substituting for them.As a result, carbon credits move from being a convenience to a discipline. Removals are increasingly expected for residual emissions, while avoidance credits are confined to voluntary leadership actions such as Beyond Value Chain Mitigation. Durability, traceability, and transparency now matter as much as price, often more.12

References:

Science Based Targets initiative (SBTi). Corporate Net-Zero Standard: Version 2.0 – Draft for Public Consultation. SBTi, 2024,

sciencebasedtargets.org/resources/files/Net-Zero-Standard-v2-Draft.pdf.Science Based Targets initiative (SBTi). Foundations for Science-Based Net-Zero Target Setting. SBTi,

sciencebasedtargets.org/net-zero.Science Based Targets initiative (SBTi). Corporate Net-Zero Standard. Version 1.0, SBTi, 2021,

sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf.Voluntary Carbon Markets Integrity Initiative (VCMI). Claims Code of Practice. VCMI, 2023,

vcmintegrity.org/claims-code/.Integrity Council for the Voluntary Carbon Market (ICVCM). Core Carbon Principles. ICVCM, 2023,

icvcm.org/the-core-carbon-principles/.University of Oxford, Smith School of Enterprise and the Environment. The Oxford Principles for Net Zero Aligned Carbon Offsetting. Oxford Martin School, 2021,

www.smithschool.ox.ac.uk/research/oxford-principles-net-zero-aligned-carbon-offsetting.Intergovernmental Panel on Climate Change (IPCC). AR6 Working Group III: Mitigation of Climate Change. IPCC, 2022,

www.ipcc.ch/report/ar6/wg3/.Energy Transitions Commission. Mind the Gap: Aligning Voluntary Carbon Markets with Net Zero. ETC, 2023,

www.energy-transitions.org/publications/mind-the-gap/.Greenhouse Gas Protocol. Corporate Value Chain (Scope 3) Accounting and Reporting Standard. World Resources Institute and World Business Council for Sustainable Development, 2011,

ghgprotocol.org/standards/scope-3-standard.CDP. Engaging the Chain: Driving Speed and Scale in Supplier Climate Action. CDP, 2023,

www.cdp.net/en/research/global-reports/engaging-the-chain.Organisation for Economic Co-operation and Development (OECD). Transparency and Integrity in Carbon Markets. OECD, 2023,

www.oecd.org/climate-change/carbon-markets/.

World Economic Forum. High-Integrity Voluntary Carbon Markets. World Economic Forum, 2023,

www.weforum.org/projects/high-integrity-voluntary-carbon-markets.