The Role of AI, Satellites & Monitoring, Reporting & Verification Technologies in the Next Generation of Carbon Credits

I. Executive Summary

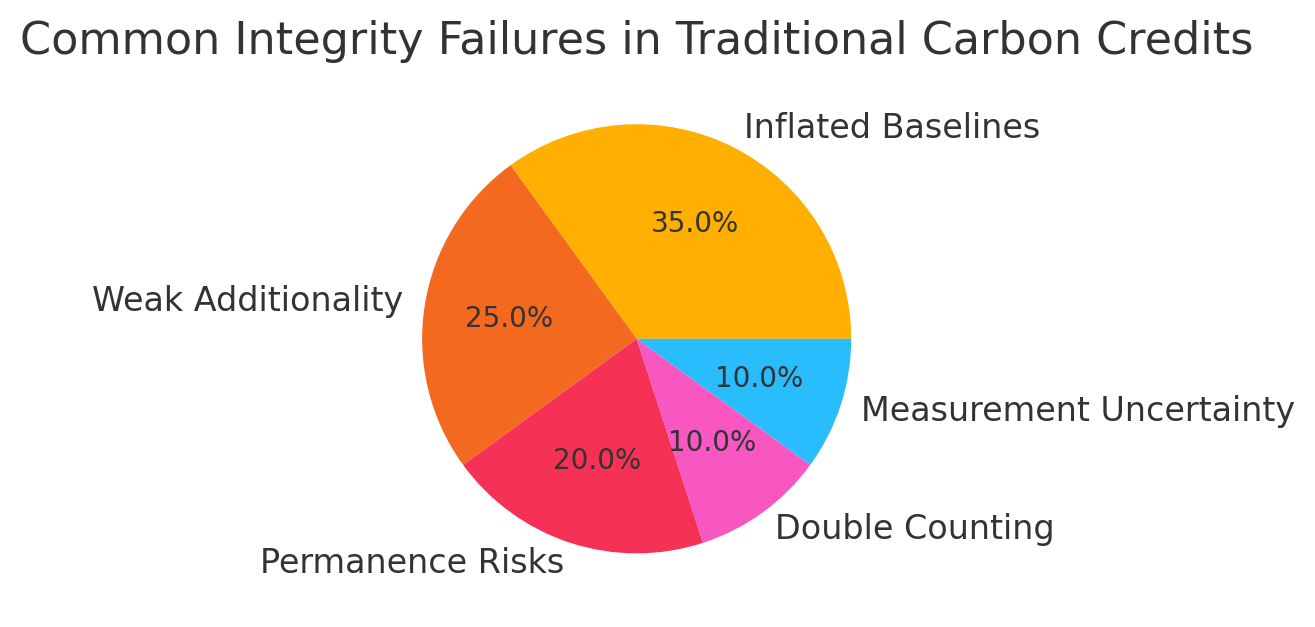

Carbon markets are facing increasing scrutiny as new research shows that many credits suffer from low integrity, including overestimated baselines, weak additionality, double counting, and limited permanence. These issues have eroded trust, with several 2024–2025 analyses warning that a significant share of existing credits may not represent real climate impact.

In response, the market is shifting toward high-integrity carbon credits, driven by stricter standards such as ICVCM/VCMI and a strong demand from buyers for transparent, verifiable climate outcomes. Central to this shift is the rapid adoption of digital MRV (Monitoring, Reporting & Verification).

New technologies AI, satellite imagery, remote sensing, IoT sensors, and blockchain-based registries, are transforming how carbon reductions are measured and verified. They enable independent, continuous, and tamper-proof monitoring at large scale, reducing reliance on manual field audits and significantly improving accuracy.1

II. Introduction: The Need for a High-Integrity Carbon Market

Voluntary carbon markets have grown rapidly over the past two decades, but their credibility has repeatedly been challenged. Early forest and land-use projects were found to overestimate emissions reductions, rely on inflated baselines, or claim additionality where none existed. Several investigative reports in recent years showed that a large portion of voluntary credits did not represent real or durable climate benefits, undermining trust among buyers, regulators, and the public.2,3

A major reason for these integrity gaps is the reliance on traditional, manual MRV (Monitoring, Reporting & Verification). Field surveys, periodic audits, and sample-based measurements leave room for human error, inconsistency, and even manipulation. They are slow, costly, and difficult to scale, especially for nature-based projects spread across large or remote geographies.

Today, global regulatory pressure is increasing. Frameworks such as the Integrity Council for the Voluntary Carbon Market (ICVCM) and Article 6 of the Paris Agreement4 demand stricter transparency, verifiable data, and alignment with internationally accepted methodologies. Companies buying credits are also facing pressure to demonstrate real climate impact.

Thesis: To meet these rising expectations, the carbon market must transition to a technology-enabled, high-integrity model. AI, satellites, sensors, and digital MRV systems will form the backbone of the next generation of carbon credits.

III. Understanding MRV: Monitoring, Reporting, Verification

A. What MRV Means in Carbon Markets

Monitoring, Reporting, and Verification (MRV)4 refers to the end-to-end system used to measure how much carbon a project reduces or removes, report these results, and independently verify their accuracy.

Monitoring involves collecting data on project activities , such as forest growth, methane capture, soil carbon levels, or energy efficiency improvements.

Reporting compiles these measurements into standardized documentation for registries, auditors, and buyers.

Verification is the independent assessment that confirms the reported carbon impact is real, measurable, and compliant with approved methodologies.

In carbon markets, MRV is the foundation for credibility. It determines whether a credit represents a genuine tonne of CO₂e reduced or removed. Accurate MRV directly influences:

Price → High-quality, well-verified credits command a premium.

Buyer confidence → Corporates and regulators rely on MRV to avoid greenwashing risks.

Market integrity → Transparent, robust MRV prevents inflated claims and double counting.

Without reliable MRV, carbon credits lose legitimacy and fail to deliver real climate impact.

B. Limitations of Traditional MRV

Despite its importance, traditional MRV systems have significant weaknesses:

Manual surveys and field audits5 are labour-intensive and often rely on small samples to represent large areas, increasing uncertainty.

Methodological variation across registries and project types leads to inconsistent results and unverifiable assumptions.

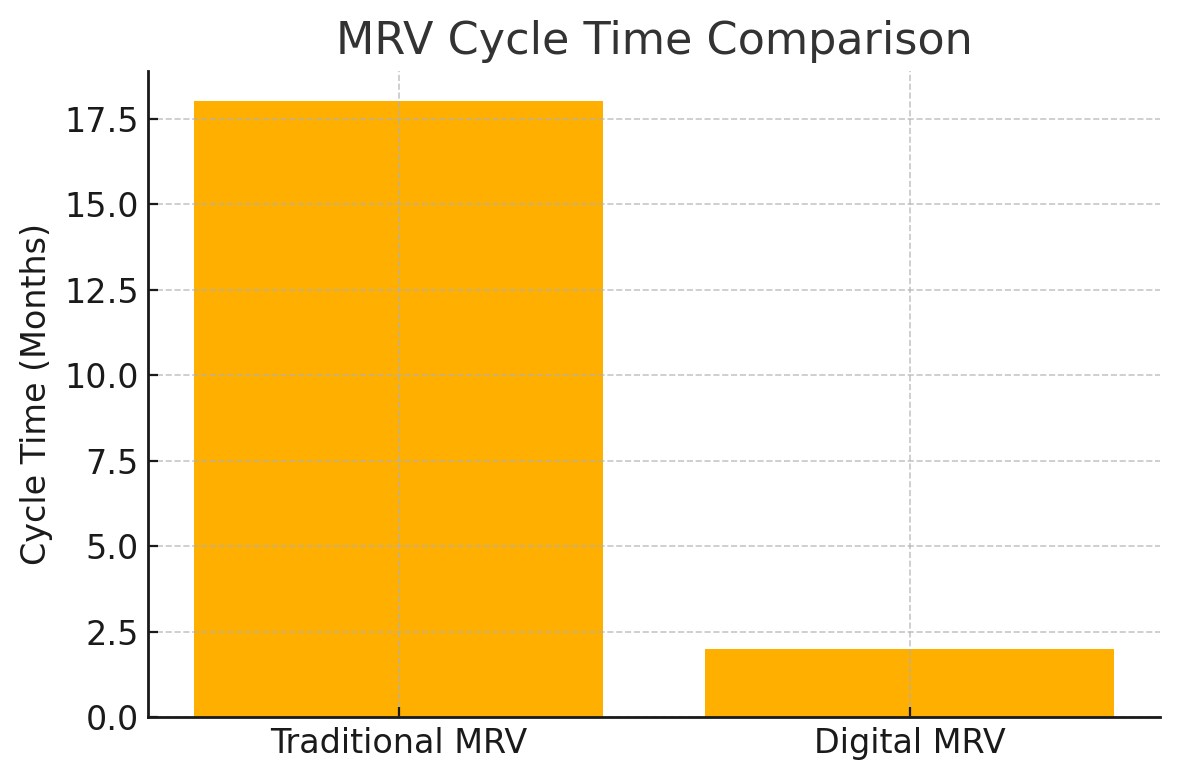

Long delays verification cycles can take 12–18 months, slowing credit issuance and preventing near-real-time accountability.

Fraud and manipulation risks arise when baselines, activity data, or project boundaries can be manually altered or misreported.

Inflated baselines have been widely documented, especially in avoided-deforestation and renewable-energy projects.

Sampling errors can produce inaccurate carbon estimates, particularly for soil carbon or biomass in heterogeneous landscapes.

Lack of scalability as demand increases, traditional MRV cannot efficiently handle thousands of projects across diverse geographies.

These limitations are a core reason why many carbon-credit projects have been criticized for low integrity, pushing the industry toward digital, technology-driven MRV systems.

IV. Satellite Technologies Transforming MRV

A. Types of Satellites Used

1. Optical Satellites (e.g., Sentinel-2, Landsat)

Optical satellites capture reflected light in multiple spectral bands, enabling detailed mapping of vegetation health, canopy cover, land-use change, and water bodies. The free and open datasets from Sentinel and Landsat form the backbone of most nature-based MRV systems.

2. Radar Satellites (SAR – Synthetic Aperture Radar)5,6

SAR satellites penetrate clouds and operate day or night, making them essential for tropical regions with frequent cloud cover. Radar data helps measure forest structure, land surface changes, flooding, and biomass patterns.

3. LiDAR (Light Detection and Ranging)

LiDAR sensors, often mounted on satellites or aircraft, emit laser pulses to create high-accuracy 3D maps of vegetation height and structure. This is crucial for estimating above-ground biomass and carbon storage with high precision.

4. Carbon-Specific Satellites (e.g., OCO-2, MethaneSAT)

These satellites are designed to measure atmospheric CO₂ and methane concentrations directly. MethaneSAT and GHGSat provide high-resolution data for detecting leaks from oil & gas, waste, and agriculture, enabling credit issuance for verified methane-reduction projects.

B. Applications in Carbon Credit Projects

Forest cover change detection: Satellites can monitor canopy gain/loss, fragmentation, and regrowth at monthly or even weekly intervals.

Biomass estimation: Combined optical, radar, and LiDAR data help estimate above-ground carbon stocks across large areas more accurately than field plots alone.

Monitoring deforestation and degradation: Near-real-time alerts identify illegal logging, fires, and degradation, improving permanence monitoring.

Fire and climate-risk tracking: Hotspot detection helps assess reversal risks in forest carbon projects.

Soil carbon measurement: Spectral analysis improves soil organic carbon estimates, reducing reliance on expensive, repeated soil sampling.

Methane leak detection: Carbon-specific satellites map methane plumes, enabling quantifiable methane-abatement credits in energy, landfill, and livestock sectors.

C. How Satellites Improve Credit Integrity

Continuous, time-stamped monitoring dramatically reduces gaps between measurement periods and ensures up-to-date visibility.

Reduced manipulation of baselines: Objective satellite data limits the ability to inflate or misreport historical land-use conditions.

Independent verification: Third-party auditors can directly cross-check project claims against publicly available satellite datasets.

Increased transparency: Open-access imagery from NASA, ESA, and emerging climate-data platforms enables broader scrutiny, improving accountability and market trust.

D. Limitations to Address

Cloud cover can obstruct optical imagery in tropical regions, requiring integration with radar sensors.

Resolution limits: Free datasets are useful but might miss small-scale activities; high-resolution imagery is still costly.

Calibration challenges: Accurate biomass estimates require ground-truth data; satellite signals must be calibrated with field measurements.

Need for integrated systems: Satellites alone cannot replace local data, combining remote sensing, field sensors, and AI models is essential for high-integrity MRV.

V. The Role of Artificial Intelligence

A. How AI Processes Satellite and Ground Data

AI plays a critical role in transforming raw satellite and sensor data into accurate carbon estimates.

Machine learning for biomass estimation: ML algorithms can analyze multi-spectral, radar, and LiDAR data to estimate above-ground biomass far more accurately than simple statistical models. AI can learn complex relationships between canopy height, vegetation density, and carbon stock.

AI-based segmentation for forest loss/gain: Computer vision models automatically detect deforestation, degradation, and regrowth by segmenting satellite images pixel by pixel. This enables highly accurate change detection across large landscapes.

Predictive modelling for baselines & leakage: AI can generate dynamic baselines that account for climate trends, land-use pressures, and socio-economic factors. Models also predict where leakage (shifting deforestation) is likely to occur, improving project integrity.6,7

B. AI in Project Auditing

AI significantly enhances the auditing process, enabling faster and more objective verification.

Automated anomaly detection: AI models flag unusual patterns, such as sudden canopy loss, unexpected land conversion, or unusual changes in project boundaries, that may indicate errors or fraud.

Fraud detection: Algorithms can identify implausible biomass growth rates, unrealistic soil carbon increases, or suspicious monitoring gaps.

AI-assisted verification: Auditors receive AI-generated insights and alerts, reducing time spent on manual data review and improving consistency across audits.

C. AI in Credit Issuance and Rating

AI is increasingly influencing credit quality assessment and issuance.

Project integrity scoring: AI evaluates project documentation, monitoring data, and historical trends to produce integrity or quality scores.

Carbon-risk scoring: Similar to MSCI, BeZero, and Sylvera methodologies, AI models assess risks related to additionality, permanence, leakage, and methodological uncertainty.

Predicting permanence & reversal risks: AI analyses fire probability, drought exposure, pest risk, and socio-economic drivers to estimate the likelihood of carbon reversals (e.g., wildfires or forest loss).

D. Benefits of AI in MRV

Speed: AI turns MRV cycles from months to days, enabling near-real-time monitoring.

Scalability: AI can process satellites, sensor streams, and ground data across thousands of projects simultaneously.

Lower MRV costs: Automation reduces the need for frequent field surveys, making carbon finance accessible to smaller community and agricultural projects.

Improved accuracy: Machine learning reduces human error, enhances precision, and improves detection of subtle land-use changes.

E. Risks and Challenges

Algorithmic bias: AI may misinterpret land-use patterns if trained on biased or limited datasets.

Lack of standardization: Different registries and platforms use different AI methods, creating inconsistencies.

Data gaps & model accuracy issues: Remote regions and data-poor geographies can lead to model uncertainty.

Transparency concerns: Many AI models operate as “black boxes,” making it difficult for auditors to validate assumptions.

Risk of over-reliance: AI should support, not replace, expert judgement and local ground-truthing.

VI. IoT Sensors, Drones & Field Technologies

A. Internet of Things (IoT) in MRV8,9

IoT sensors are transforming how carbon projects collect field-level data, making MRV more precise, continuous, and tamper-resistant.

Soil moisture, soil carbon, and methane sensors: In agricultural and soil-carbon projects, sensors can measure soil organic carbon, moisture levels, and temperature continuously. In industrial or waste-management projects, methane sensors detect real-time emissions from landfills, digesters, or oil & gas infrastructure.

Real-time data streaming: IoT devices transmit data directly to cloud platforms, enabling continuous monitoring instead of periodic sampling. This reduces uncertainty and helps project developers respond quickly to anomalies, such as methane spikes or soil carbon losses.

Improved accuracy across project types: For nature-based solutions, IoT sensors complement remote sensing by providing ground-truth data on soil carbon and microclimate conditions. For industrial carbon projects (e.g., methane capture), IoT enables quantifiable, high-frequency emissions measurements that strengthen credit integrity.

B. Drones for Localized Verification

Drones play a crucial role in bridging the gap between ground-based measurements and satellite observations.

High-resolution mapping: Equipped with multispectral, thermal, or LiDAR sensors, drones capture centimetre-level imagery that satellites often miss , useful for smallholder farms, fragmented forests, and mangrove ecosystems.

Biomass and canopy height measurement: LiDAR-enabled drones can create 3D vegetation models, improving estimates of above-ground biomass and carbon stock, especially in dense forests.

Surveillance for illegal logging or fires: Drones can quickly detect forest disturbances, unauthorized land clearing, or wildfire ignition, helping projects address permanence risks in near-real time.

C. Combined Sensor + Satellite + AI Systems (Hybrid MRV)

The future of high-integrity carbon markets lies in integrating multiple data sources into unified, automated MRV frameworks.

Hybrid MRV frameworks: Combining top-down satellite monitoring with bottom-up IoT data and drone imagery10 creates a more accurate and verifiable picture of carbon dynamics. Satellites provide continuous macro-level monitoring, while field sensors and drones offer granular, project-level precision.

AI-enabled integration: Machine learning models synthesize these datasets , satellite imagery, drone LiDAR, soil sensors , to estimate carbon stocks, detect anomalies, and refine baselines with significantly reduced uncertainty.

Real-world use cases:

Forest carbon: Satellites detect canopy changes; drones verify disturbance; sensors track microclimate and soil carbon.

Agriculture: Soil sensors measure carbon; drones map crop cover; AI models quantify sequestration from regenerative practices.

Biochar: IoT devices monitor feedstock carbon content and pyrolysis conditions for accurate credit issuance.

Blue carbon: Combined technologies map tidal movement, mangrove density, sediment carbon, and water chemistry.

This integrated approach supports the development of high-integrity, digitally verified carbon credits with lower uncertainty and significantly reduced MRV costs.

VII. Blockchain & Digital MRV (dMRV) Systems

A. Why Blockchain Matters

Blockchain provides the trust infrastructure needed for credible carbon markets, especially as digital MRV becomes the norm.

Immutable data storage: Once monitoring data (e.g., satellite readings, IoT sensor outputs, drone scans) is recorded on a blockchain, it cannot be altered or deleted. This prevents retroactive manipulation of project evidence.

Timestamped monitoring records: Every entry , whether a soil carbon reading or methane detection , is automatically recorded with a timestamp, enabling transparent timelines of emissions reductions or removals.

Prevents double counting and fraudulent issuance: Blockchain-based registries ensure each carbon credit has a unique identifier. This prevents the same credit from being sold multiple times across different markets or registries , a major historical issue in voluntary carbon markets.

B. Digital MRV Architecture

Digital MRV combines multiple advanced technologies in a unified system for automated, verifiable carbon accounting.

Automated data pipelines: Data flows seamlessly from field sensors, satellite imagery, and AI analytics directly into carbon registries. This minimizes manual intervention and reduces reporting errors.

Smart contracts for automated credit issuance: Rules embedded in blockchain smart contracts can automatically trigger credit issuance once predefined conditions are met for example, “issue credits when methane emissions fall below threshold X" or “release credits after biomass growth reaches Y tons.”

These automated mechanisms increase trust, reduce administrative costs, and shorten verification cycles.

C. Benefits of Blockchain & Digital MRV

Transparency & auditability: Every action, monitoring data upload, verification checks, credit issuance, or retirement, is traceable. Auditors and buyers can independently verify project history.

Faster credit lifecycle: Digital MRV reduces verification time from months or years to weeks or days, allowing quicker revenue flows for project developers.

Alignment with global integrity standards: Digital MRV systems support emerging requirements from ICVCM (Integrity Council for the Voluntary Carbon Market) and VCMI (Voluntary Carbon Markets Integrity Initiative) by ensuring accurate data, traceability, and compliance-ready documentation.10

Together, blockchain and digital MRV form the backbone of high-integrity, technology-enabled carbon markets that can scale reliably.

VIII. Case Studies & Real-World Examples

1. Pachama

Pachama is a leading example of how AI and satellite technology are reshaping forest-carbon verification.

The company uses machine learning, LiDAR, and multi-spectral satellite imagery to monitor forest conditions, estimate biomass, and detect forest loss in near real-time.

Pachama’s system generates digital baselines, objective, satellite-derived references for forest conditions, reducing the risk of inflated or manipulated baselines.

It also issues verified forest-loss alerts, enabling faster responses to illegal logging or fires and improving permanence monitoring across project lifecycles.

2. NCX (Natural Capital Exchange)

NCX pioneered a novel approach to forest carbon using short-term, data-driven contracts.

The platform uses AI and high-resolution remote sensing to estimate forest carbon stocks at the parcel level across millions of acres.

It introduced “harvest deferral credits”, where landowners are paid to delay timber harvesting for one year, creating measurable carbon benefits.

NCX’s model demonstrated how frequent, technology-enabled MRV can support scalable, low-cost forest carbon programs involving thousands of small landowners.

3. UNFCCC / Article 6 Pilot Programs

Several countries are testing digital MRV frameworks to support international carbon trading under Article 6 of the Paris Agreement.

Pilot projects use satellite data, IoT sensors, digital registries, and automated reporting systems to standardize how emissions reductions are monitored and transferred between countries.

These digital approaches aim to reduce disputes, prevent double counting, and provide transparent evidence for Internationally Transferred Mitigation Outcomes (ITMOs).

Early pilots in countries like Chile, Ghana, and Switzerland highlight the potential for fully digital international carbon markets.

4. MethaneSAT / GHGSat

MethaneSAT and GHGSat represent a new class of satellites designed specifically to measure methane emissions.

These missions provide high-resolution methane leak detection, enabling project developers to quantify emissions reductions from oil & gas operations, landfills, and livestock systems.

The data allows the creation of methane abatement credits, where reductions are directly linked to observed, measurable methane plumes.

This offers one of the most verifiable and high-integrity credit types, given methane’s strong warming impact and the precision of the measurements.

5. Soil Carbon Monitoring Startups

A new wave of climate-tech companies is tackling the challenge of soil carbon MRV.

Startups use remote sensing, machine learning, and minimal ground sampling to estimate soil organic carbon across large agricultural landscapes.

Technologies combine spectral satellite data, field sensors, and AI models to reduce reliance on expensive, repeated soil coring.

This digital approach is enabling soil carbon programs that are more affordable, scalable, and transparent, allowing smallholder farmers to participate in carbon markets.

IX. Impact of Emerging Technologies on Carbon Markets

A. Improving Credit Quality

Digital MRV technologies significantly raise the integrity of carbon credits by tightening the link between claimed impact and actual climate impact.

Real impact vs claimed impact: Satellite monitoring, IoT sensors, and AI analytics reduce uncertainty and prevent exaggerated or unverifiable claims, ensuring that each issued credit represents a real tonne of CO₂e reduced or removed.

More accurate baselines: Technology enables baselines derived from long-term satellite records and predictive models rather than subjective or static assumptions. This reduces the risk of inflated baselines, a major problem in historical forest and renewable energy projects.

Higher trust = higher price: Buyers increasingly pay a premium for credits supported by transparent data and third-party verifiable monitoring. High-integrity, digitally verified credits are already commanding higher prices in many voluntary market segments.

B. Increasing Liquidity & Scaling Demand

Digital MRV is helping carbon markets mature and become more liquid.

Large corporates demanding high-integrity credits: Companies with net-zero commitments (especially in Europe and the U.S.) prefer credits with strong data-driven verification to avoid reputational and regulatory risks.7,8

Compliance markets integrating voluntary MRV standards: Emerging compliance systems, such as Article 6 mechanisms and national carbon markets, are beginning to accept digital MRV as a basis for issuing or recognizing credits. This expands market demand and brings voluntary and compliance markets closer together.

C. Cost Reductions Enabling Small Projects

Technology dramatically lowers the cost of operating MRV, opening carbon finance to smaller participants.

Smallholder agriculture & community forestry: AI models, drone imagery, and automated soil carbon monitoring make it possible to quantify carbon outcomes for thousands of small plots that were previously too expensive to measure.

More inclusive carbon finance: Reduced MRV costs mean small farmers, forest communities, and local cooperatives can participate in carbon programs, increasing equity and broadening global participation.

D. Greater Market Transparency

Digital tools contribute to a more open and trustworthy carbon ecosystem.

Public dashboards and open verification models: Platforms now publish satellite-based forest alerts, methane leak maps, and carbon-stock estimates that anyone can access.

Democratising access to robust climate data: Open-source imagery from ESA, NASA, and climate-tech initiatives allows stakeholders, buyers, auditors, NGOs, and local communities, to independently review project performance.This transparency increases accountability and helps build a more credible global carbon market.8,9

X. Challenges & Ethical Considerations

The rapid adoption of AI, satellites, and digital MRV introduces new challenges and ethical questions that carbon markets must address to ensure fairness, accuracy, and inclusivity.

1. Data Privacy Concerns for Indigenous and Local Communities

High-resolution satellite imagery, drone flights, and on-ground sensors can unintentionally capture sensitive information about indigenous territories, land-use patterns, or community activities.

Many communities have not given explicit consent for this monitoring.

Misuse of land data can lead to conflicts, displacement risks, or external control over community resources.

Addressing this requires strong data-governance frameworks, community engagement, and safeguards that respect land rights.

2. Risk of Over-Reliance on Automation

While AI-driven MRV improves accuracy, it also risks turning verification into a “black box.”

Automated models may overlook contextual factors, such as local land rights, cultural practices, or socio-economic drivers, that influence carbon outcomes.

Blind trust in algorithms without human oversight can lead to misinterpretation, incorrect credit issuance, or unfair project evaluations.

Human expertise must remain central to interpreting digital MRV outputs.

3. Unequal Access to High-Quality Data Leading to Bias

Not all countries or project developers have equal access to:

high-resolution satellite data,

computing infrastructure,

AI expertise, or

advanced sensors.

This can result in geographical bias, where well-resourced regions generate more high-integrity credits, while low-income regions struggle to meet new digital standards. Ensuring equitable access is essential for global participation.10,11

4. Ensuring Tech-Driven MRV Does Not Exclude Small Players

Digital MRV can lower costs, but without inclusive design, it may still favor large developers.

Smallholder farmers, community forestry groups, and indigenous cooperatives may lack digital literacy or financial resources.

Strict data requirements could unintentionally push them out of carbon markets.

Capacity building, simplified tools, and subsidized access to digital MRV are necessary to avoid exclusion.

5. Need for Digital Governance and Global Standards

As technology becomes central to carbon markets, consistent rules are needed.

There is currently no universal digital MRV standard, leading to incompatible methodologies and inconsistent certification practices.

Clear guidelines from ICVCM, UNFCCC, and national regulators are needed to govern data quality, transparency, algorithmic accountability, and interoperability.

Without strong governance, digital MRV risks creating fragmented markets and inconsistent credit integrity.9,10

XI. The Future: A Fully Digital Carbon Market

A. Vision for 2030

By 2030, digital MRV is expected to be the backbone of global carbon markets.

Fully digital MRV becomes the norm: Satellite monitoring, AI analytics, IoT sensors, and blockchain registries will replace manual, paper-based verification cycles. Projects will be assessed continuously rather than once every few years.

Carbon registries integrate AI verification: Registries will incorporate automated integrity checks, flagging inconsistencies in baselines, biomass estimates, or emissions data before credits are issued.

Near-real-time emissions quantification: Advances in satellite missions , including methane-detection satellites and high-frequency CO₂ sensors , will allow continuous tracking of key GHG sources. This will enable credits tied to verified, observed emission reductions rather than estimated models.7-9

B. Market Transformation

The widespread adoption of digital MRV will reshape supply, demand, and price dynamics in carbon markets.

Traditional offsets replaced by high-integrity, tech-verified credits: Credits will increasingly be issued based on high-resolution, verifiable data, reducing reliance on narrative-based project documentation.

Rapid decline of low-quality credits: Transparency tools, public dashboards, and independent AI verifiers will expose exaggerated claims and weak projects. As trust grows in high-integrity credits, poor-quality offsets will lose market value and gradually disappear from major carbon marketplaces.

Greater liquidity and institutional participation: Digitally verified credits will meet the requirements of more compliance markets, unlocking larger pools of capital.

C. Role of Regulators & Standards

Regulators and standard-setting bodies will play a critical role in shaping the digital carbon economy.

Integration with ICVCM, VCMI, and Article 6: Global frameworks will increasingly incorporate digital MRV principles, requiring transparent data, standardized methodologies, and interoperable reporting systems.

Push toward global harmonization: Countries and registries will move toward shared digital protocols for baselines, satellite data use, AI model disclosure, and monitoring cycles. This harmonization will reduce fragmentation and ensure that credits are comparable across markets.

Regulatory alignment enabling hybrid markets: As digital MRV aligns voluntary and compliance standards, credits will more easily transition between markets, increasing demand and strengthening the credibility of international carbon trading.

XII. Conclusion

Digital transformation is essential for restoring credibility in carbon markets because it replaces subjective, inconsistent, and easily manipulated MRV practices with transparent, data-driven verification. Technologies like AI, satellites, sensors, and blockchain provide measurable, tamper-proof evidence of real emissions reductions, ensuring that carbon credits genuinely reflect climate impact. Yet technology is not a substitute for robust climate action , it is an enabler. Human oversight, strong governance, and community participation remain crucial to ensure that these tools are applied fairly and ethically. Ultimately, the convergence of advanced monitoring systems is reshaping carbon markets into transparent, scalable, and trustworthy mechanisms capable of supporting global climate goals and driving high-integrity climate finance at scale.

References:

European Space Agency (ESA). Sentinel-2 Mission Overview. ESA, 2024, https://www.esa.int/Applications/Observing_the_Earth/Copernicus/Sentinel-2.

GHGSat. Methane Emissions Monitoring Technology. GHGSat, 2024, https://www.ghgsat.com.

Integrity Council for the Voluntary Carbon Market (ICVCM). Core Carbon Principles and Assessment Framework. ICVCM, 2023.

Landsat Science (NASA/USGS). Landsat Mission Overview. NASA, 2024, https://landsat.gsfc.nasa.gov.

MethaneSAT. Mission Overview. Environmental Defense Fund, 2024, https://www.methanesat.org.

Natural Capital Exchange (NCX). Data-Driven Forest Carbon Platform. NCX, 2023, https://ncx.com.

Pachama. Technology and Methodology for Forest Carbon Verification. Pachama, 2024, https://pachama.com.

Paris Agreement, Article 6. UNFCCC Guidance on Cooperative Approaches and International Carbon Markets. UNFCCC, 2023.

Sylvera. Carbon Credit Ratings Methodology. Sylvera, 2024, https://www.sylvera.com.

United Nations Framework Convention on Climate Change (UNFCCC). Digital MRV and Transparency Framework Guidance. UNFCCC, 2024.

Voluntary Carbon Markets Integrity Initiative (VCMI).VCMI Claims Code of Practice. VCMI, 2023.