What Makes a Carbon Credit Truly Investable?

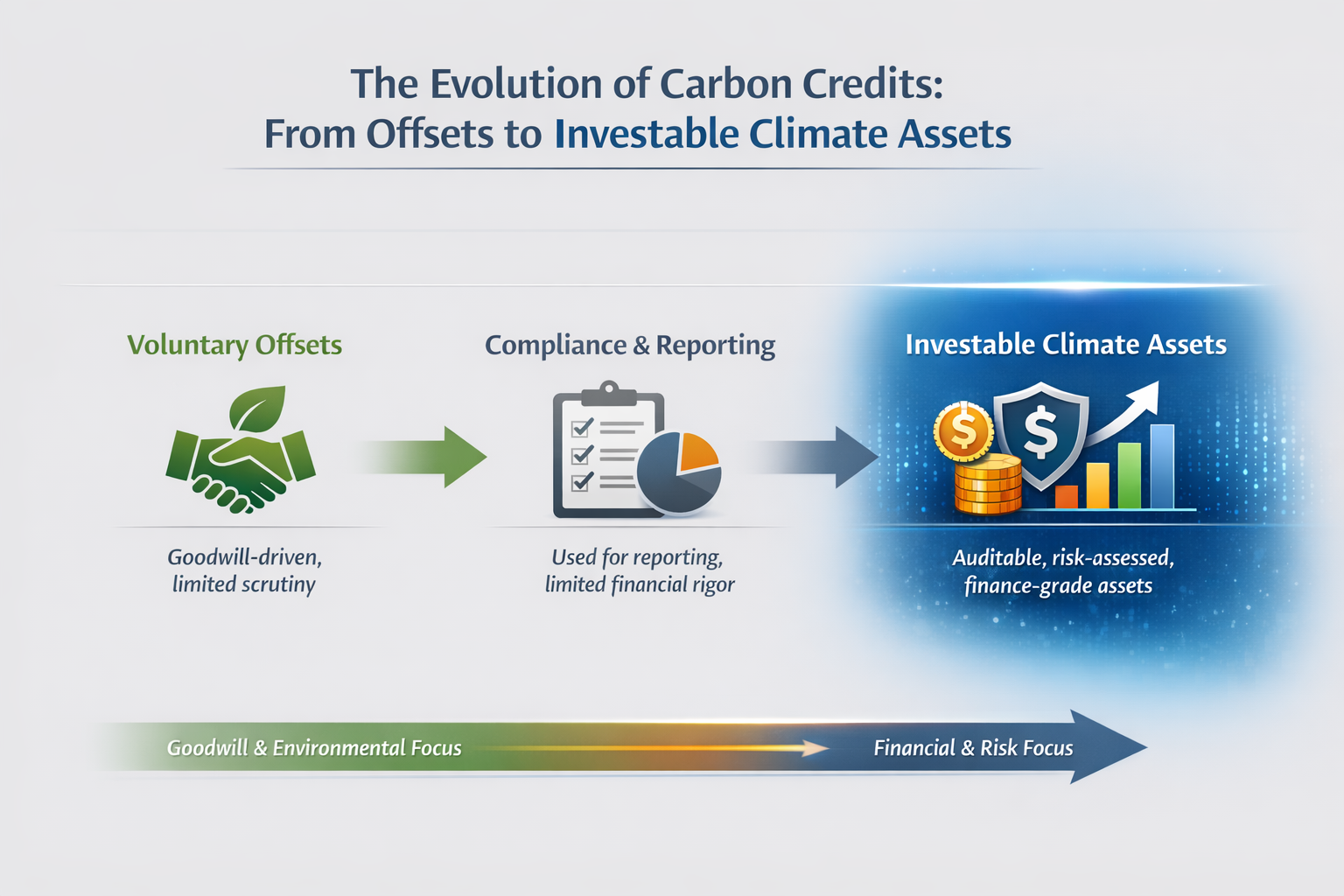

The conversation around carbon credits is rapidly evolving. What was once viewed as a voluntary sustainability gesture is now becoming a serious financial and strategic decision for organizations worldwide. Carbon markets are no longer driven solely by goodwill, they are increasingly shaped by accountability, performance, and long-term value creation.1

This shift is being fueled by a broader set of stakeholders entering the space:

Corporates with science-based net-zero commitments that require credible, auditable climate action

Institutional investors seeking climate-aligned assets with measurable impact and risk-adjusted returns

Financial regulators and rating agencies demanding transparency, integrity, and consistency in climate disclosures

As a result, the market is facing a critical challenge: not all carbon credits are created equal. Variations in quality, permanence, additionality, and verification have exposed the limits of traditional offsetting models.2

This has led to a defining question for the market:

What separates a “tradable” carbon credit from a truly “investable” one?

The answer lies in rigor, governance, and credibility. Carbon credits are no longer viewed merely as environmental instruments, they are increasingly evaluated as financial assets that must withstand due diligence, regulatory scrutiny, and long-term value assessment.

This shift marks a turning point in how climate action is financed and measured.

2. The Evolution of Carbon Credits: From Compensation to Capital Allocation

Early Days: Purpose-Driven but Loosely Governed

Carbon offsets began as purpose-driven tools aimed at compensating emissions by funding reduction projects, often without strict rules or financial scrutiny. In the early voluntary market, standards were inconsistent, making it difficult to compare credit quality or assess real climate impact.

Early milestone: The first voluntary offset projects emerged in the late 1980s and 1990s, primarily designed to raise awareness about climate responsibility rather than enforce accountability or performance standards.3,4

Rise of Voluntary Carbon Markets (VCM)

Voluntary carbon markets expanded in the early 2000s as companies sought flexible ways to demonstrate climate commitment outside regulatory mandates. These markets enabled corporations to purchase credits linked to emission-reduction projects, often as part of CSR or sustainability initiatives.

Over time, demand grew for high-integrity credits, supported by stronger verification, third-party standards, and transparent methodologies to improve trust and comparability.

Shift from Symbolic Offsets to Measurable Climate Impact

As scrutiny increased, weaknesses in early offset markets became evident, particularly around additionality, permanence, and leakage. This prompted a shift toward more rigorous methodologies and verification frameworks.

Global climate agreements such as the Kyoto Protocol and later the Paris Agreement accelerated this transition by embedding carbon markets into broader climate governance and emphasizing measurable, reportable, and verifiable outcomes.

Why Capital Markets Now Care About Carbon Credits

As carbon markets mature, financial institutions increasingly treat credits as investment instruments rather than symbolic climate gestures. Three core factors now define credibility:

1. Durability

Credits must represent long-lasting climate benefits, with strong safeguards against reversal or degradation.

2. Risk-Adjusted Returns

Investors assess carbon credits through the lens of risk, performance, and future price stability, similar to other asset classes. This includes evaluation of project risk, regulatory exposure, and delivery certainty.

3. Credibility and Permanence

Market confidence increasingly depends on transparent methodologies, standardized reporting, and third-party verification frameworks such as those promoted by global regulators.

Parallel with ESG Evolution: From Reporting to Accountability

The trajectory of carbon markets mirrors the evolution of ESG itself, shifting from voluntary disclosures to structured, auditable, and decision-relevant frameworks. Climate data is no longer peripheral; it is becoming integral to financial risk assessment, capital allocation, and long-term value creation.

Today, carbon credits are increasingly treated as strategic financial instruments, embedded within enterprise risk management and climate transition planning rather than standalone sustainability gestures.

3. The Core Criteria That Define an “Investable” Carbon Credit

As carbon markets mature, investors are no longer evaluating credits based on volume or intent alone. Instead, they apply rigorous criteria similar to those used in traditional financial markets. A carbon credit is considered investable only when it demonstrates measurable climate impact, durability, and transparency across its lifecycle.5,6

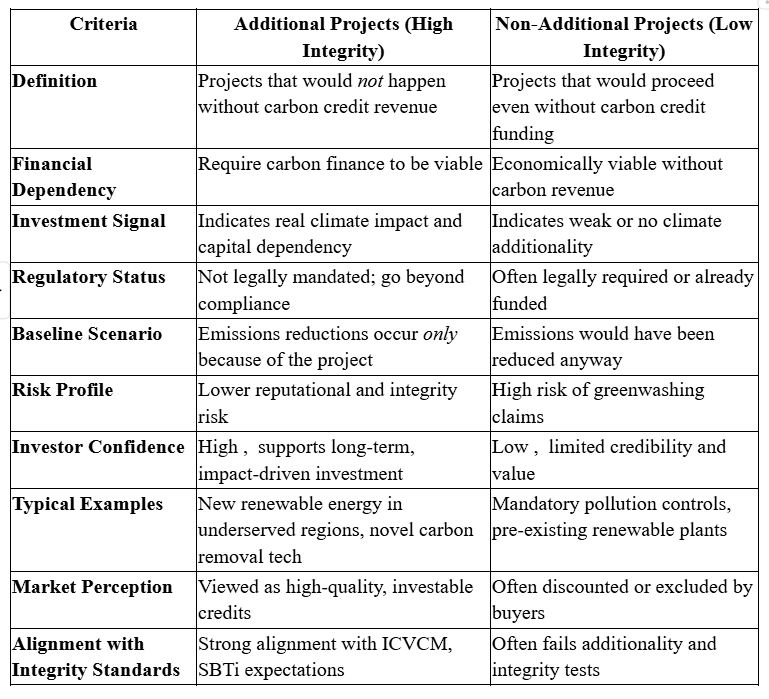

3.1 Additionality

Additionality refers to whether a carbon reduction or removal would have occurred without the revenue from carbon credits. If a project would have happened anyway, issuing credits provides no real climate benefit.

According to the Integrity Council for the Voluntary Carbon Market (ICVCM), additionality is a core quality principle, as non-additional credits distort market integrity and undermine climate outcomes.

(Source: ICVCM Core Carbon Principles, 2023)

Common pitfalls

Projects that are already financially viable without carbon revenue

Government-mandated activities incorrectly claiming voluntary credit status

Retroactive crediting of historical projects

Criteria

Additional Projects (High Integrity)

Non-Additional Projects (Low Integrity)

Definition

Projects that would not happen without carbon credit revenue

Projects that would proceed even without carbon credit funding

Financial Dependency

Require carbon finance to be viable

Economically viable without carbon revenue

Investment Signal

Indicates real climate impact and capital dependency

Indicates weak or no climate additionality

Regulatory Status

Not legally mandated; go beyond compliance

Often legally required or already funded

Baseline Scenario

Emissions reductions occur only because of the project

Emissions would have been reduced anyway

Risk Profile

Lower reputational and integrity risk

High risk of greenwashing claims

Investor Confidence

High , supports long-term, impact-driven investment

Low , limited credibility and value

Typical Examples

New renewable energy in underserved regions, novel carbon removal tech

Mandatory pollution controls, pre-existing renewable plants

Market Perception

Viewed as high-quality, investable credits

Often discounted or excluded by buyers

Alignment with Integrity Standards

Strong alignment with ICVCM, SBTi expectations

Often fails additionality and integrity tests

Why investors scrutinize counterfactuals

Institutional investors increasingly assess whether carbon revenues genuinely influenced project viability. Weak additionality introduces reputational, regulatory, and financial risk, particularly as disclosure requirements tighten.

3.2 Permanence

Understanding permanence

Permanence refers to how long carbon benefits remain intact. Some projects, especially nature-based ones, face risks of reversal due to wildfires, land-use change, or political instability.

Nature-based vs. technology-based permanence

Credit Type

Typical Permanence Risk

Afforestation / REDD+

High (fire, deforestation, land-use change)

Soil carbon

Medium (management dependent)

Direct Air Capture

Low (geological storage)

Risk mitigation mechanisms

Buffer pools (shared insurance reserves)

Long-term monitoring obligations

Reversal risk discounting

Why it matters:

Institutional investors increasingly price permanence risk into valuations, similar to credit default risk in fixed-income markets.

3.3 Measurability & Verifiability

Why measurement quality matters

Investors require carbon outcomes to be quantifiable, auditable, and repeatable. Poor measurement weakens confidence and limits financial comparability.7,8

Key elements of credible measurement

Robust baselines and methodologies

Periodic third-party verification

Transparent data reporting and audit trails

Leading verification bodies include Verra, Gold Standard, and American Carbon Registry, all of which are strengthening MRV (Measurement, Reporting, Verification) standards.

Impact on market confidence

High-quality MRV reduces information asymmetry and increases price confidence, making credits more suitable for institutional portfolios.

3.4 Leakage Risk

What Leakage Means

Leakage occurs when emissions reductions achieved in one location lead to an increase in emissions elsewhere, resulting in little or no net climate benefit. While a project may appear successful within its defined boundary, the overall emissions profile remains unchanged if activities simply shift geographically or operationally.

Common Examples of Leakage

Deforestation displacement: Forest protection in one region pushes logging or land conversion to neighboring areas.

Industrial relocation: Emission-intensive activities move across borders or jurisdictions to avoid stricter environmental regulations.

Market leakage: Reduced supply in one area leads to increased production elsewhere to meet demand.

Why Leakage Matters

Leakage undermines the environmental integrity of carbon credits and erodes trust among buyers and investors. If emissions are merely displaced rather than reduced, the claimed climate benefit becomes overstated, exposing investors to reputational, regulatory, and credibility risks.

From a capital markets perspective, leakage introduces systemic risk, as credited reductions may not represent genuine or lasting climate impact.

Mitigation Strategies

Jurisdictional or sector-wide approaches that account for regional displacement effects rather than isolated project boundaries.

Conservative crediting methodologies that discount potential leakage risks upfront.

Continuous monitoring and adaptive management, allowing methodologies to adjust as economic or land-use conditions change.

By proactively addressing leakage, carbon credit programs can strengthen environmental integrity and enhance investor confidence in the long-term value of credited reductions.

3.5 Transparency & Traceability

Why Traceability Is Foundational

Transparency and traceability are critical to the credibility of carbon markets. End-to-end visibility across the carbon credit lifecycle, from project registration and issuance to transfer and retirement, ensures that each credit represents a unique, verifiable unit of climate impact.

Without clear traceability, markets face risks such as double counting, unclear ownership, and unverifiable claims, all of which undermine buyer confidence and long-term market integrity.

Key Enablers of Traceability

Public digital registries that provide open access to project details, issuance records, and retirement status

Unique serial numbers assigned to each credit to ensure singularity and prevent duplication

Clear ownership and retirement records, enabling buyers to demonstrate credible use and claims

Role of Digital Infrastructure

To further strengthen integrity, markets are increasingly adopting digital MRV tools and exploring blockchain-enabled registries. These technologies improve data immutability, automate audit trails, and enhance interoperability across registries, reducing the risk of double counting and increasing confidence among institutional participants.8

Initiatives such as the World Bank’s Climate Warehouse aim to create a global, interoperable infrastructure that connects registries and supports transparent, high-integrity carbon markets.

Why It Matters for Investors

For investors, strong traceability lowers operational, regulatory, and reputational risk. Credits with transparent lifecycle records are more likely to meet emerging disclosure standards and remain resilient as carbon markets evolve toward greater financial scrutiny.

4. Why Data Quality Determines Financial Credibility

In carbon markets, data quality is not a technical detail, it is a core determinant of financial credibility. Poor or inconsistent data introduces uncertainty, weakens confidence in climate claims, and increases both reputational and regulatory risk for buyers.

Poor Data = Hidden Risk

When emissions data is incomplete, outdated, or inconsistently measured, it creates blind spots in project performance. These gaps can mask underperformance, inflate impact claims, and expose investors to future write-downs or compliance challenges.

How Inconsistent Baselines Distort Value

Inaccurate or shifting baselines can artificially inflate emissions reductions, overstating a project’s real impact. Without standardized baseline methodologies, credits may represent accounting differences rather than genuine climate benefits, undermining market integrity.

Manual vs. Digital MRV Systems

Traditional, manual measurement and reporting processes are prone to human error, delays, and limited verification. In contrast, digital MRV systems enable continuous data capture, automated validation, and consistent reporting across project lifecycles.

The Role of Technology

Remote sensing enables independent monitoring of land-use change, forest cover, and emissions trends at scale.

Satellite data improves accuracy, frequency, and geographic coverage, reducing reliance on self-reported data.

AI-based verification enhances anomaly detection, risk scoring, and consistency across datasets.

Together, these technologies strengthen transparency and reduce information asymmetry between project developers and credit buyers.

Why Buyers Demand Auditable Data Trails

Institutional buyers increasingly require end-to-end traceability, from project registration to credit retirement, to meet internal risk, compliance, and disclosure standards. Auditable data trails ensure that credits can withstand regulatory scrutiny and support credible climate claims.9

Key Takeaway

High-quality data is the foundation of investability.

Without reliable, verifiable, and transparent data, carbon credits cannot function as trusted financial instruments.

5. The Risk Lens: What Can Go Wrong With “Low-Quality” Credits

As carbon markets mature, the risks associated with low-quality credits are becoming increasingly visible. What were once seen as reputational concerns are now translating into measurable financial, legal, and strategic exposure for buyers.

Reputational Risk

When credits are later questioned or discredited, organizations face reputational fallout, particularly if claims of climate leadership are publicly challenged. In an era of heightened scrutiny from media, investors, and civil society, reputational damage can quickly erode brand trust and stakeholder confidence.

Regulatory Exposure

Evolving climate disclosure requirements and emerging carbon market regulations mean that credits once considered acceptable may no longer meet compliance or reporting standards. Companies relying on weak or opaque credits risk non-compliance, regulatory scrutiny, and potential enforcement actions.

Financial Write-Downs

When credits are invalidated, downgraded, or deemed non-compliant, their financial value can drop sharply. This can lead to asset impairments, restatements, or the need to repurchase higher-quality credits, directly impacting balance sheets and financial forecasts.

Loss of Stakeholder Trust

Investors, customers, and partners increasingly expect credible, verifiable climate action. The use of questionable credits can undermine confidence, weaken ESG ratings, and affect access to capital or partnerships.

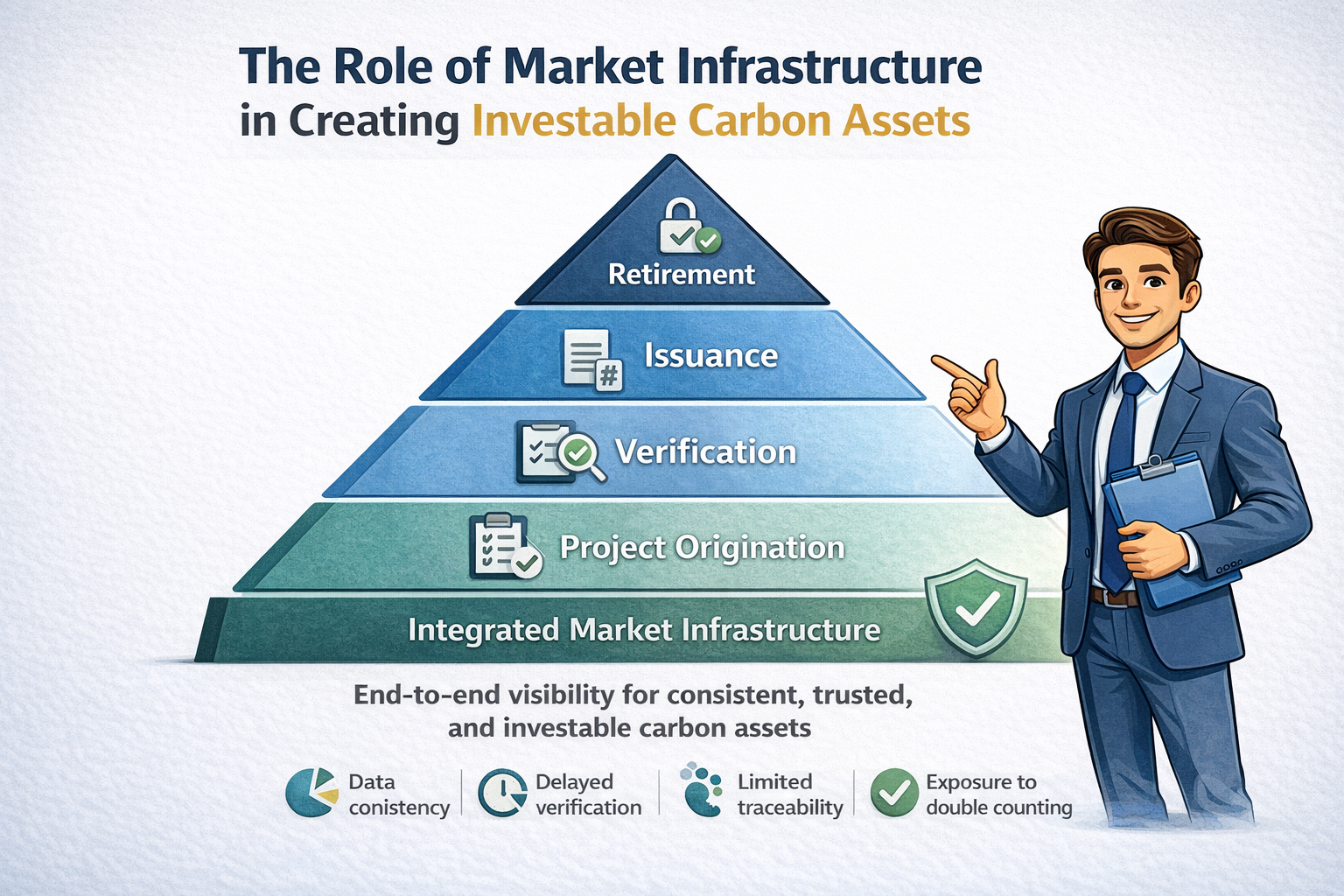

6. The Role of Market Infrastructure in Creating Investable Carbon Assets

As carbon markets mature, the quality of underlying infrastructure is becoming just as important as the quality of the credits themselves. Fragmented systems, inconsistent data standards, and disconnected registries increase operational risk and weaken investor confidence.10,11

Why Fragmented Systems Increase Risk

When data is scattered across multiple platforms, project developers, verifiers, registries, and buyers, visibility breaks down. This fragmentation creates blind spots around ownership, verification status, and credit history, making it difficult to assess true risk or ensure integrity across the credit lifecycle.

Without integrated infrastructure, even high-quality projects can suffer from:

Data inconsistencies

Delayed verification

Limited traceability

Increased exposure to double counting or misreporting

The Importance of End-to-End Visibility

For carbon credits to function as investable assets, stakeholders need continuous visibility across every stage of the lifecycle:

Project Origination – Clear documentation of methodologies, baselines, and assumptions

Verification – Independent validation and audit trails that confirm reported outcomes

Issuance – Transparent credit creation with unique identifiers

Retirement – Verifiable proof that credits have been permanently retired and cannot be reused

End-to-end visibility transforms carbon credits from opaque instruments into traceable financial assets.

How Modern Climate Infrastructure Enables Trust

Next-generation climate platforms are addressing these challenges by providing shared, interoperable infrastructure that improves market integrity. Key capabilities include:

Standardized data frameworks that ensure consistency across projects and geographies

Reduced information asymmetry between developers, buyers, and regulators

Improved audit readiness through real-time data access and documented audit trails

Rather than acting as marketplaces, such platforms function as trust layers, enabling verification, transparency, and confidence without distorting price discovery.

Key Insight

Robust market infrastructure is the foundation of investable carbon markets.

When data flows are transparent, auditable, and interoperable, carbon credits can be evaluated with the same rigor as other financial assets.

7. What Buyers Should Look for Before Investing in Carbon Credits

As carbon markets mature, buyers must move beyond intent-driven purchases and adopt a structured evaluation approach. The checklist below highlights the essential criteria for assessing whether a carbon credit is truly investable.

1. Clear Project Documentation

Ensure the project provides complete, transparent documentation covering:

Project design and baseline assumptions

Methodology used for emissions calculation

Roles of developers, verifiers, and registry bodies

Well-documented projects reduce ambiguity and support long-term credibility.

2. Transparent Pricing Rationale

Pricing should reflect:

Project type and risk profile

Permanence and durability of emissions reductions

Verification costs and long-term monitoring obligations

A clear pricing structure helps buyers understand what they are paying for, and why.

3. Verified Methodologies

Credits should be issued under recognized, science-aligned methodologies and validated by independent third parties. Verification ensures that reductions are real, measurable, and aligned with accepted standards.10,11

4. Alignment With Internal Climate Goals

Buyers should assess whether the credits:

Align with their net-zero or decarbonization pathway

Support residual emissions rather than substitute for reduction efforts

Fit within broader ESG and sustainability strategies

Alignment prevents misuse and strengthens credibility with stakeholders.

5. Long-Term Monitoring and Reporting Plan

High-quality projects include provisions for:

Ongoing monitoring across the project lifecycle

Regular reporting and re-verification

Clear protocols for addressing underperformance or reversals

This ensures performance over time, not just at issuance.

6. Data Accessibility for Audits and Disclosures

Investors and regulators increasingly expect:

Easy access to project data and documentation

Clear audit trails and historical records

Compatibility with reporting frameworks and disclosure requirements

Accessible, well-structured data reduces compliance risk and supports future reporting needs.

Key Takeaway

High-quality carbon credits are not bought, they are diligence-tested.

A disciplined evaluation framework helps buyers manage risk, demonstrate credibility, and align carbon purchases with long-term climate and financial objectives.

8. The Future of Investable Carbon: Where the Market Is Heading

The carbon market is entering a phase of consolidation and maturation. As scrutiny increases and expectations rise, the focus is shifting away from volume-driven offsetting toward quality, accountability, and long-term value creation.

Shift Toward Fewer, Higher-Quality Credits

The market is moving away from large volumes of low-integrity credits toward a smaller pool of high-quality, high-integrity assets. Buyers are increasingly prioritizing projects with strong additionality, robust verification, and long-term climate impact over low-cost, high-volume options.

Increased Regulatory Oversight

Governments and standard-setting bodies are strengthening oversight to address greenwashing and ensure consistency across markets. Emerging frameworks and disclosure requirements are pushing carbon credits closer to regulated financial instruments, raising the bar for transparency, documentation, and accountability.7,8

Rising Demand for Traceability and Digital MRV

As scrutiny grows, demand for traceable, auditable data is accelerating. Digital MRV systems, leveraging remote sensing, automation, and data analytics, are becoming essential for verifying performance and ensuring integrity across the credit lifecycle.

Integration with ESG and Financial Reporting

Carbon credits are increasingly being evaluated alongside traditional ESG metrics and financial disclosures. Organizations are expected to demonstrate how credit usage aligns with emissions reduction pathways, transition plans, and risk management frameworks.

The Emergence of Carbon as an Asset Class

Together, these shifts are redefining carbon credits as investable instruments rather than discretionary sustainability tools. As standards mature and data quality improves, carbon credits are beginning to function more like structured financial assets, subject to due diligence, risk assessment, and portfolio-level decision-making.

Hestiya’s Role in Enabling Investable Carbon Markets

Hestiya plays a critical role in transforming carbon credits from fragmented environmental instruments into credible, investable financial assets. By acting as a neutral infrastructure layer, Hestiya addresses the core challenges of transparency, data integrity, and trust that have historically limited the scalability of carbon markets.

At the foundation, Hestiya provides end-to-end visibility across the carbon credit lifecycle, from project origination and verification to issuance, tracking, and retirement. This unified view reduces fragmentation across registries, verifiers, and stakeholders, ensuring that every credit can be traced, audited, and validated with confidence.

Through standardized data frameworks and interoperable systems, Hestiya enables consistent documentation, verifiable audit trails, and real-time access to project information. This significantly lowers information asymmetry for buyers, investors, and regulators, helping them assess risk with the same rigor applied to traditional financial assets.

By strengthening transparency, traceability, and accountability, Hestiya helps shift carbon markets away from fragmented, trust-based mechanisms toward robust, investment-grade infrastructure. In doing so, it enables carbon credits to function not just as sustainability instruments, but as credible financial assets capable of supporting long-term climate and capital allocation strategies.11

9. Conclusion: From Carbon Credits to Climate-Grade Capital

The evolution of carbon markets has made one reality clear: not all carbon credits are created equal. As scrutiny intensifies, the distinction between symbolic offsets and credible climate assets is becoming impossible to ignore.

The next phase of the market will reward credits, and the organizations that use them, that demonstrate:

Transparency in data, methodologies, and lifecycle tracking

Data integrity through verifiable, auditable, and consistent measurement

Long-term impact supported by durable outcomes and strong governance

Carbon credits are no longer viewed as peripheral sustainability tools. They are increasingly treated as strategic instruments, subject to the same expectations of rigor, accountability, and performance as other financial assets.

For companies navigating this transition, the opportunity is clear: those who invest early in quality, traceability, and credible climate action will not only mitigate risk but also position themselves as leaders in a rapidly evolving low-carbon economy.

References:

Carbon Market Watch. Integrity Matters: Understanding Quality in Carbon Markets. Carbon Market Watch, 2022, www.carbonmarketwatch.org.

Gold Standard. The Gold Standard for the Global Goals: Principles and Requirements. Gold Standard Foundation, 2023, www.goldstandard.org.

Integrity Council for the Voluntary Carbon Market (ICVCM). Core Carbon Principles (CCPs). ICVCM, 2023, www.icvcm.org.

Intergovernmental Panel on Climate Change (IPCC). AR6 Climate Change 2023: Synthesis Report. Intergovernmental Panel on Climate Change, 2023, www.ipcc.ch.

International Emissions Trading Association (IETA). The Future of Voluntary Carbon Markets. IETA, 2022, www.ieta.org.

Organisation for Economic Co-operation and Development (OECD). Enhancing Transparency and Integrity in Carbon Markets. OECD Publishing, 2022, www.oecd.org.

Science Based Targets initiative (SBTi). Corporate Net-Zero Standard. SBTi, 2021, sciencebasedtargets.org.

Taskforce on Scaling Voluntary Carbon Markets (TSVCM). Final Report. Institute of International Finance, 2021, www.iif.com.

United Nations Framework Convention on Climate Change (UNFCCC). Article 6 of the Paris Agreement. United Nations, 2015, unfccc.int.

World Bank. State and Trends of Carbon Pricing 2023. World Bank Group, 2023, www.worldbank.org.

World Economic Forum. Building Trust in Voluntary Carbon Markets. World Economic Forum, 2023, www.weforum.org.